Loan Settlement: Understanding the Bank Loan Settlement Process

The process of obtaining a bank loan settlement remains unclear to most people who want to know about its steps and protective measures. However, recent trends show that you are

It costs you your peace and relationships. The “chain” of debt isn’t visible, but you feel its weight every day.

If you are juggling multiple personal loans or credit card dues, facing harassment, or borrowing just to pay EMIs—it’s time to break the debt chain.

Don’t let debt steal another year of your life.

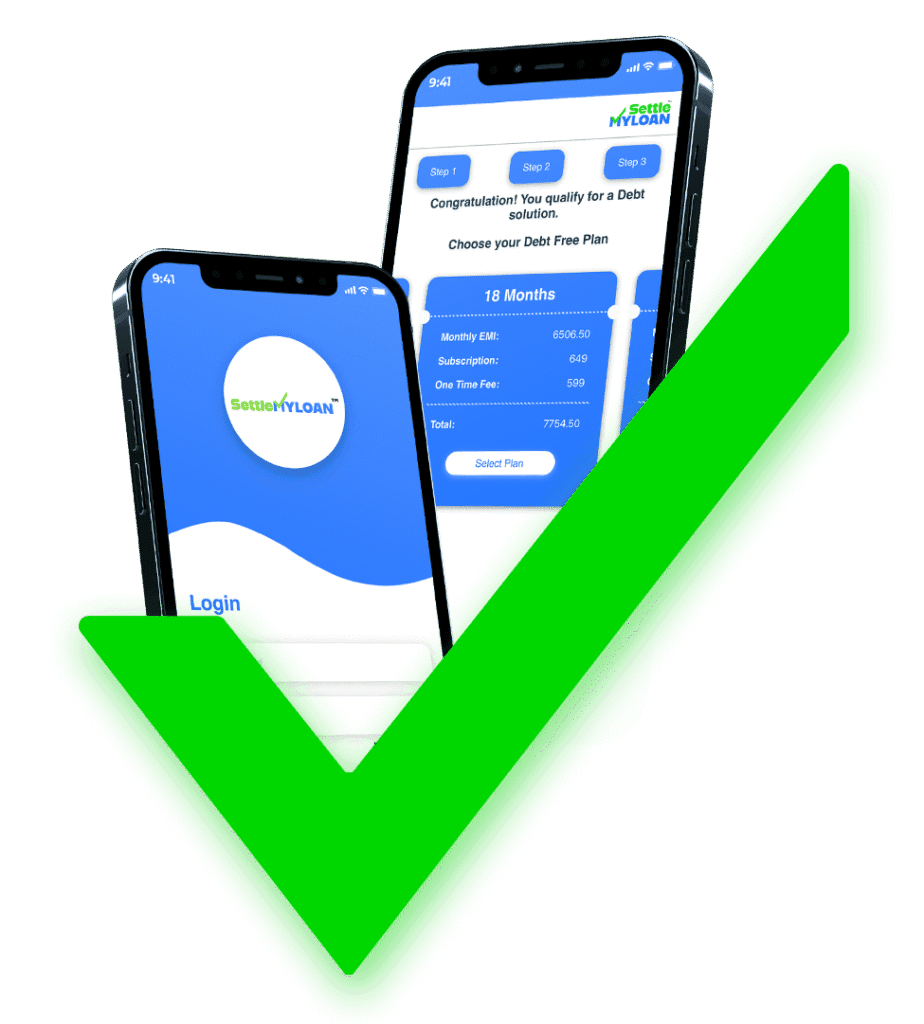

A structured and legal debt relief program designed by Settle My Loan (SML). Our goal is to stabilize your finances, stop the harassment, and secure a legal settlement agreement within the shortest possible time frame.

Book your FREE consultation. Our experts analyze your financial gap and confirm your eligibility for the 45 Days Settlement Challenge.

You enroll and sign the authorization. We immediately notify your creditors. The harassment stops or is legally managed by us. You start building your settlement fund.

Our experts negotiate aggressively with lenders using RBI guidelines. You pay the reduced lump sum. The debt chain is broken. You start 2026 celebrating with your family and live a debt-free life.

All settlements are structured strictly under RBI’s "Fair Practices Code" and OTS guidelines

No false promises. We tell you the risks (credit score impact) and the rewards (freedom) upfront

Supporting clients in Mumbai, Delhi, Bangalore, and 50+ cities

40-70% reduction in debt repayment amount for thousands of Indian families

Our dedicated team of in-house advocates manages all legal notices and arbitrations, ensuring you are never alone in a legal battle

The process of obtaining a bank loan settlement remains unclear to most people who want to know about its steps and protective measures. However, recent trends show that you are

In difficult times, loans work as lifelines for both individuals and businesses alike. But what to do when, due to unforeseen circumstances, loan repayments become unmanageable? In such times, One-Time

As the year winds down, the “festive hangover” isn’t just physical—it’s financial. For many Indian households, the combination of Diwali, Eid & Christmas shopping, wedding season or vacation expenses, and

Client Details Name: Abdul Salim Khatib Age: 52 City: Mumbai Total Outstanding Debt: ₹10,75,772 Client Background & The Crisis: Abdul Salim Khatib, a 52-year-old resident of Mumbai, faced a “perfect

Client Background & Challenge: Rahul Haryan, a 40-year-old entrepreneur from Mumbai, faced a devastating financial crisis following the COVID-19 pandemic. Once running a successful business, he saw his livelihood collapse

Challenge Mohammad Parvez, a resident of Ghansoli, Mumbai, was facing catastrophic financial and emotional distress. Driven by a desperate attempt to recover a ₹1 crore loss in the share market,

Yes. Loan settlement is a legally recognized process under Indian contract law and RBI guidelines for Non-Performing Assets (NPAs).

Yes, a settlement is reported as “Settled,” which impacts your score temporarily. However, this is a strategic trade-off to avoid the long-term damage of a default. Crucially, SML provides dedicated financial guidance to help you rebuild and boost your credit score once your debts are cleared, setting you on a path to full financial recovery.

Once you enroll, we legally notify your creditors to direct communication to us. While it takes a few days for banks to update records, our “Harassment Shield” ensures you are protected from illegal recovery tactics.

You have a choice today. Continue the struggle, or start the solution.