Do you know that banks in India settle thousands of loans every year for less than what’s actually owed—and most borrowers don’t even realise they can negotiate it? Surprised? You’re not alone. In fact, as per Financial Express, a growing number of borrowers in 2023 successfully negotiated personal loan settlements with banks due to rising defaults and credit stress.

So, if you’re feeling trapped under the weight of EMIs, credit card dues, or unsecured loans—breathe. You do have options, and yes, you can negotiate your way out of debt. Let me walk you through the exact strategies, insider tips, and do’s and don’ts that can help you lower your settlement amount—and why platforms like Settle My Loan can change your financial future.

When loans go unpaid for a long time, especially unsecured loans, they often shift focus from recovering the full amount to recovering as much as they can. This is where you step in with financial negotiation knowledge that makes sense for both sides.

Banks would prefer a partial payment over a prolonged legal battle. So, even if your debt seems overwhelming, you may be surprised at how open banks are to negotiation when approached strategically.

When loans go unpaid for a long time, especially unsecured loans, they often shift focus from recovering the full amount to recovering as much as they can. This is where you step in with financial negotiation knowledge that makes sense for both sides.

Banks would prefer a partial payment over a prolonged legal battle. So, even if your debt seems overwhelming, you may be surprised at how open banks are to negotiation when approached strategically.

Here are tried-and-tested strategies that can help you negotiate with banks for a lower settlement amount:

Transparency wins. Whether you’re facing job loss, medical issues, or a drop in income, share it. Lenders appreciate borrowers who are upfront—it humanizes you beyond just numbers on a file.

If you can arrange a lump sum—even if it’s 40% to 60% of your total outstanding—you may be eligible for an OTS. As seen on SettleMyLoan.in, borrowers in advanced debt cycles have successfully settled loans this way.

If lump sum isn’t feasible, go for a term settlement. This allows you to repay in installments over 3–12 months. It’s especially useful when you’re just starting to rebuild your finances.

Want to protect your credit score? Then push for a settlement that includes credit clearance, where your credit file shows “NIL” dues instead of “Settled.” It makes a huge difference in future loan eligibility.

Always document your settlement terms and get written confirmation from the bank. Don’t proceed based on verbal agreements alone.

A company director from Mahabubnagar approached us seeking relief from creditor harassment and unmanageable business debt after the Covid-19 lockdown severely impacted his operations. He had two unsecured loans from Bajaj Finserv with six missed EMIs, totaling ₹19,13,269.

Our legal team negotiated a one-time settlement of ₹6,40,000, securing a 67% waiver and saving him ₹12,73,269. Our advocates thoroughly vetted the bank’s settlement letter, ensuring the terms were legally sound and marked as full and final.

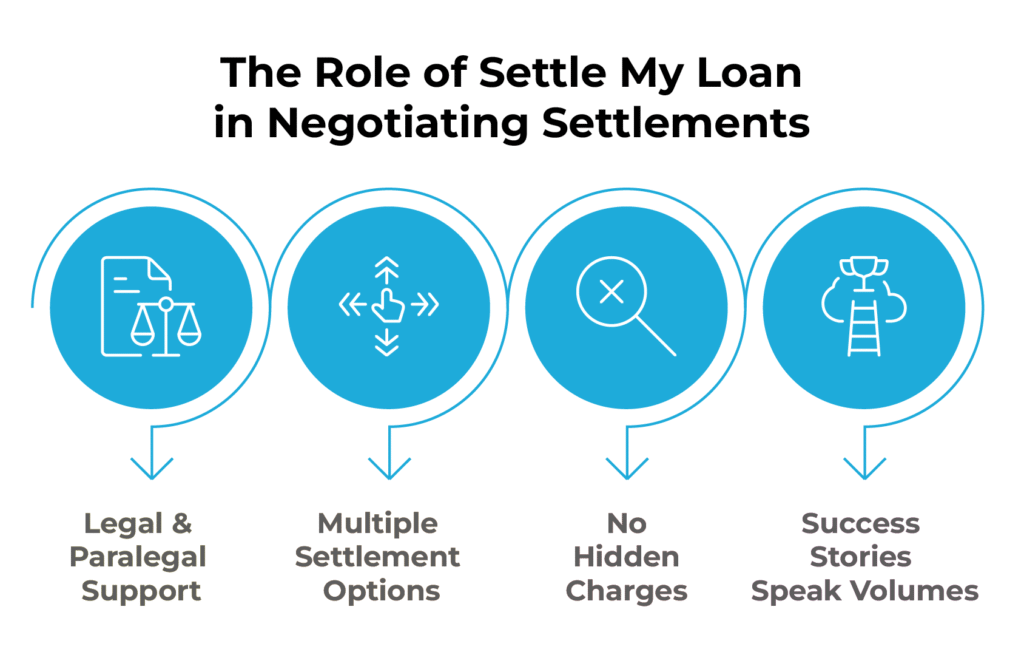

Settle My Loan (SML) isn’t just another debt relief company—it’s your ally in this negotiation journey. Here’s how they stand apart:

Success Stories Speak Volumes: Clients with significant debt have walked away debt-free within months through strategic negotiation.

Always aim for settlement with credit clearance if possible.

Many fear loan settlements because of their credit score impact. Here’s the truth:

This is why negotiating debt repayment terms is about more than just discounts—it’s about long-term financial health.

Negotiating with banks may feel intimidating—but you’re not powerless. With the right strategy, the right timing, and the right partners, you can reduce your debt, protect your credit, and move forward with confidence. Remember, banks want to recover, not punish—and you can negotiate a fair deal.

If you’re unsure where to begin or just want professionals to handle it, reach out to Settle My Loan. Their team of legal experts, paralegals, and settlement negotiators will work with you and for you—because getting out of debt shouldn’t mean getting out of peace.

Absolutely! Banks are usually in the mood to reduce the amount of settlement particularly in case you are in a tight financial situation. Instead of running out to lose the whole amount in case you default fully, they would prefer getting back part of the debt. It is about hitting a win-win by returning part of the money to them and you will get some relaxation.

You should begin by calling your bank over the phone and telling them the truth about your situation. Make it clear that you want to have a loan settlement on hardship. Always be ready with evidence of your statement, i.e. the changes in income or some incidents of untimely expenses, in order to maintain your case to receive a lesser amount.

There is no definite minimum but it does differ widely according to your particular loan and the policies of the bank you are dealing with as well as how much you can reasonably afford. Most often settlement offers average 40 to 80 percent of the outstanding balance. The trick is to make a realistic bid that you can really afford and one that is also profitable to the bank.

Yes, but (it may not be easy at once). Paying off a loan may affect your credit adversely so that you will not get new credit quickly enough. Nevertheless, given enough time and proper financial conduct, as well as the restoration of your credit score, you will certainly be able to be entitled to loans in future.

Yes, the debt settlement involves negotiation at the core. In both cases (using a debt settlement company and going it alone), it is of paramount importance that there be constant contact with the lenders and negotiation. They tend to accept the offer of a settlement rather than get involved in the matters of collection or possible bankruptcy.

2 Responses

Plice sir arjant madekal bil panding

Dealing with loan recovery issues can be stressful but we’re here to help. Please contact us at:

022 68762607

+91 86554 48389

Email us: info@settlemyloan.in

Sincerely,

The Settle My Loan Team