Delhi’s high cost of living, combined with unexpected expenses, often pushes individuals and MSMEs into unmanageable debt. This leads to mounting penalties, aggressive creditor calls, and sleepless nights.

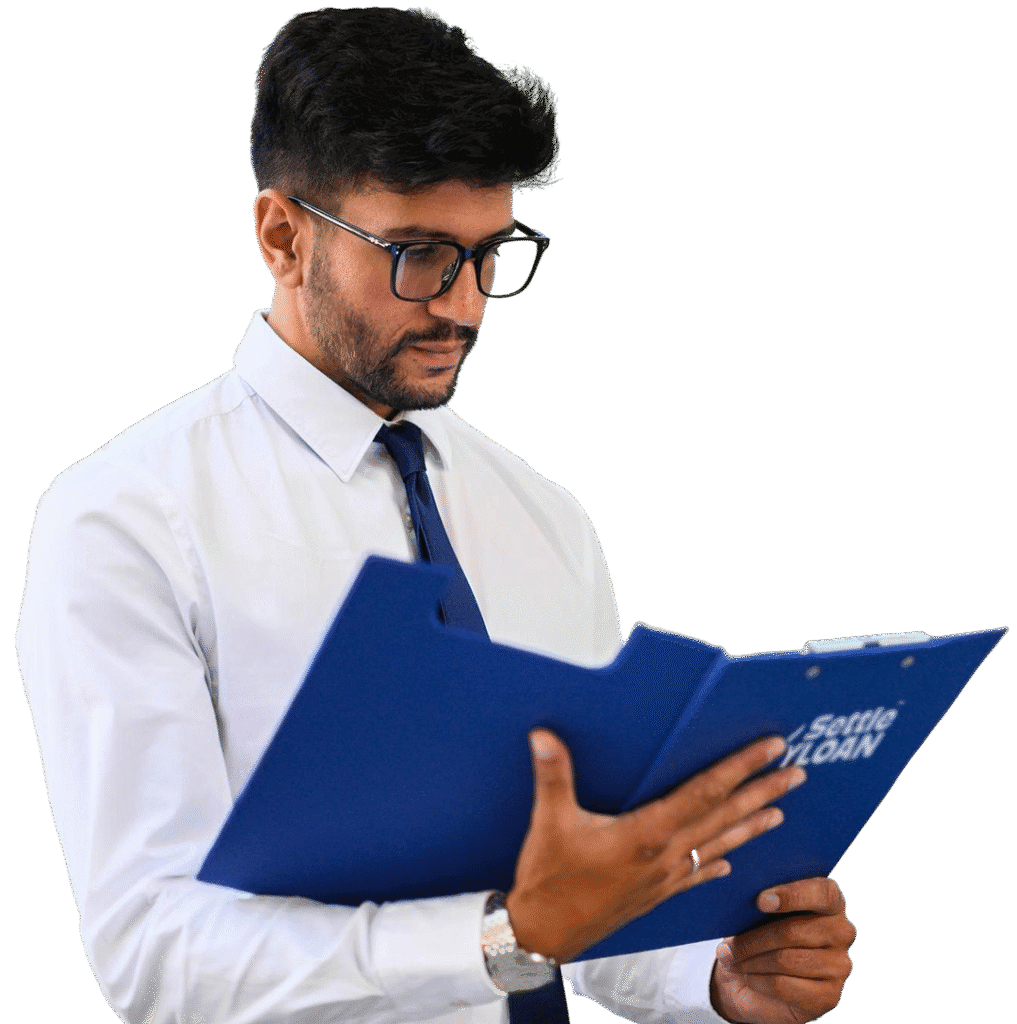

Settle My Loan (SML), a specialized debt resolution company, focuses on Debt Settlement, helping you achieve permanent relief by:

Debt Settlement is a specialized process for borrowers in genuine financial hardship to resolve their unsecured debt for less than the full amount owed.

Maximum Reduction: Negotiate lump-sum settlement down to the lowest possible amount (often 40-70% reduction).

Anti-Harassment Shield: Redirect calls and visits to our legal team, operating strictly under RBI guidelines in the NCR.

Legal Vetting: Our experts handle legal notices before they escalate to Delhi court matters (e.g., Tis Hazari, Patiala House).

Credit Rebuilding Plan: Post-settlement guidance to mitigate the effects of "Settled" mark and strategically rebuild your CIBIL score.

You receive the same Head Office-level expertise without needing to visit a local branch. Our entire process is secure, digital, and remote.

We follow a disciplined, compliant process to ensure your settlement is legally valid and protects your rights as a borrower across India.

All documentation and updates are handled through our secure online portal and mobile app, offering complete transparency every step of the way.

We specialize exclusively in securing Debt Settlement, giving us deep expertise and leverage in achieving the best possible debt reduction for you.

Trusted by Customers: 95% satisfaction Rate