Loan settlement is a process where you negotiate with your lender to pay off a loan for less than the total amount owed. This typically occurs when you are experiencing financial hardship and cannot make the full loan payments. The lender agrees to accept a reduced amount as a full settlement of the debt, which can help you avoid default or bankruptcy. As a settlement company, facilitating loan settlements involves assessing your client’s financial situation, negotiating with lenders, and helping both parties reach a mutually agreeable solution.

SettleMyLoan is a well know financial advisory and debt settlement company which provides financial and legal advice to its clients and protects them from loan harassment by recovery agents. SettleMyLoan’s well poised to assist you with all kinds of debt management plans which will help you secure your financial future.

Loan settlement, also known as debt settlement or debt negotiation, is a process where you negotiate with a lender to pay a lump sum that is less than the total amount owed on a debt. This often occurs when you are experiencing financial hardship and cannot afford to make regular payments. In debt settlement, you settle your outstanding loan balance by paying an amount which is lower than the full, outstanding balance and in debt consolidation, all your outstanding loan balances are consolidated in one single amount which makes repayments easier after due agreement with your creditors.

Negotiation: The borrower or a debt settlement company negotiates with the lender to reduce the total amount of the debt.

Lump-Sum Payment: The borrower agrees to pay a lump sum, which is typically less than the full balance owed, to settle the debt.

Credit Impact: Settling a debt can negatively impact the borrower’s credit score, as the lender reports the settlement as less than the full amount owed. SettleMyLoan also offers the options of credit clearance or reversal settlement to keep your credit score healthy.

Tax Implications: The forgiven amount might be considered taxable income under Indian Tax law . This is because the cancelled or discharged debt( the amount that you save on the loan settlement) is added back to your taxable income and then subject to tax.

Eligibility: Not all debts can be settled, and lenders are not obligated to agree to a settlement. The lender may ask for the payment of a single lumpsum. The settlement is documented specifying the payment amount, payment due date and any other conditions, including the payment deadline.

Loan settlement can be an option for individuals who are struggling with large amounts of unsecured debt, such as credit card debt or personal loans, and are unable to keep up with their payments.

From the perspective of a loan provider company, loan settlement can offer several advantages:

Recovery of Funds: Loan settlement allows the financial institution to recover a portion of the outstanding debt that might otherwise go unpaid. Even if it’s less than the full amount, recovering something is better than nothing.

Reduction in Non-Performing Assets (NPAs): Loan settlement helps in reducing the number of non-performing assets on the company/ bank’s balance sheet. This can improve the financial health and credit rating of the company/ bank.

Improved Cash Flow: Settling a loan can provide immediate cash flow, which can be used for other profitable ventures or to improve liquidity.

Administrative Cost Savings: Pursuing defaulted loans through legal means can be time-consuming and costly. Settlement can reduce these administrative and legal costs.

Customer Retention: Offering a settlement can help maintain a relationship with the borrower, who might be a potential future customer if their financial situation improves.

Focus on Core Activities: By settling bad debts, the loan provider can focus on its core lending activities rather than spending resources on collections.

Regulatory Compliance: Settling loans can help the financial institution comply with regulatory requirements regarding the handling of bad debts and can prevent penalties associated with high levels of NPAs.

Positive Public Image: Demonstrating a willingness to negotiate and work with borrowers can improve the company’s public image, showing that they are flexible and understanding in times of financial hardship.

Minimized Risk of Bankruptcy: For borrowers facing severe financial difficulties, loan settlement can prevent bankruptcy, which might result in the financial instritution receiving little to nothing.

Improved Financial Metrics: Reducing bad debts can improve key financial metrics, such as return on assets and return on equity, making the company or bank more attractive to investors.

While loan settlement means accepting less than the full amount owed, these advantages can make it a viable and sometimes necessary strategy for loan agencies dealing with distressed debts.

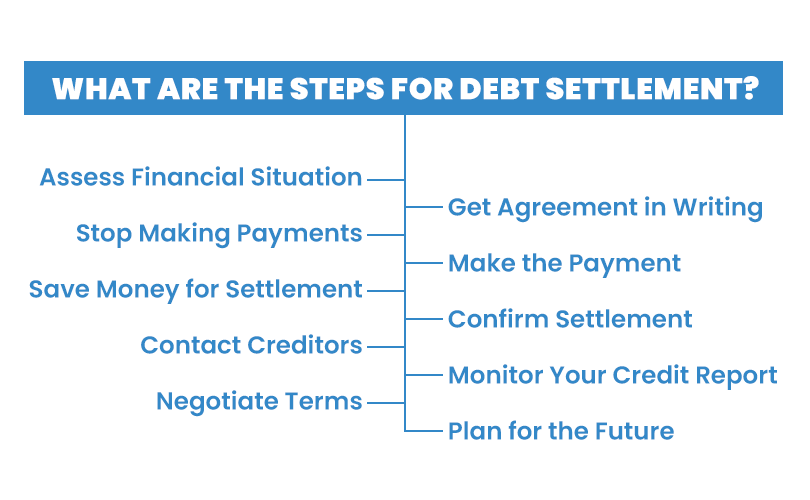

Are you drowning in debt and desperate for a financial lifeline? Debt settlement is a solution that involves negotiating with creditors to reduce the overall debt owed, often by making a lump sum payment that is less than the total amount due. Depending on your individual circumstances, the settlement amount can vary between 10% to 80% of what you owe. Here are the steps typically involved in debt settlement:

Assess Your Financial Situation:

Review all your debts, income, and expenses to understand your financial position.

Determine how much you can afford to offer as a lump sum payment.

Research Debt Settlement Options:

Consider whether to handle the settlement process yourself or hire a debt settlement company.

Research reputable debt settlement companies if you decide to seek professional help.

Stop Making Payments:

Some debt settlement strategies involve stopping payments to creditors to build a settlement fund and demonstrate financial hardship.

Save Money for Settlement:

Set aside money each month to accumulate a lump sum that can be offered for settlement.

Open a separate savings account to keep these funds.

Contact Creditors:

Reach out to your creditors to negotiate a settlement through a loan settlement company like SML. Explain your financial situation and offer a lump sum payment that you can afford.

Negotiate Terms:

Be prepared to negotiate and provide documentation of your financial hardship if needed.

Aim to settle the debt for 40-60% of the original amount owed, but the exact percentage can vary.

Get Agreement in Writing:

Once a settlement is reached, get the agreement in writing from the creditor.

Ensure the written agreement states that the settled amount will be considered payment in full.

Make the Payment:

Pay the agreed-upon lump sum by the deadline specified in the settlement agreement.

Use a method that provides proof of payment, such as a crossed check or bank transfer.

Confirm Settlement:

Follow up with the creditor to confirm that the debt has been settled and that your account reflects this.

Keep records of all correspondence and proof of payment.

Monitor Your Credit Report:

Check your credit report to ensure the settled debt is reported correctly.

It may take a few months for the settlement to be reflected on your credit report.

Plan for the Future:

Create a budget and financial plan to avoid accumulating debt in the future.

Consider seeking credit counseling to improve your financial habits and credit score.

Debt settlement can provide relief, but it also has significant consequences, such as damaging your credit score and potentially facing tax implications on the forgiven debt. Carefully weigh the pros and cons and consider consulting with a financial advisor before proceeding.

In India, the percentage of debt offered as a settlement in a loan settlement can vary widely depending on several factors such as the financial condition of the borrower, the lender’s policies, and the negotiation process. Typically, banks and financial institutions might agree to settle the loan for a percentage of the outstanding debt, which can range from 30% to 70%.

However, these figures are not fixed and can differ based on individual circumstances. Borrowers who are in severe financial distress may sometimes be able to negotiate a higher reduction, while others might settle for a smaller percentage. It is advisable to approach the lender and negotiate the terms based on the specific situation.

Financial advisory agencies play a significant role in negotiating loan settlements by acting as intermediaries between borrowers and lenders. Their involvement can help streamline the negotiation process and potentially lead to more favorable terms for the borrower. Here’s a detailed breakdown of their role:

Assessment of Financial Situation:

Review Financials: They thoroughly review the borrower’s financial situation, including income, expenses, assets, and liabilities.

Debt Analysis: They analyze the total debt owed, interest rates, and repayment terms to understand the borrower’s current standing.

Developing a Negotiation Strategy:

Identifying Objectives: They help the borrower identify their primary objectives, such as reducing the principal amount, lowering interest rates, or extending the repayment period.

Formulating Proposals: They develop proposals that align with the borrower’s goals and are likely to be acceptable to the lender.

Negotiation with Lenders:

Communication: They initiate and maintain communication with lenders, presenting the borrower’s case and negotiating terms.

Leveraging Expertise: With their knowledge of the financial industry, they can leverage market conditions and lender policies to negotiate better terms.

Exploring Settlement Options:

Lump-Sum Settlement: They may negotiate for a lump-sum payment that is less than the total amount owed.

Reduced Payment Plans: They can negotiate for reduced monthly payments or lower interest rates.

Extended Repayment Terms: They may work to extend the loan term to reduce monthly payment amounts.

SettleMyLoan offers different types of settlement including One time settlement, one time settlement with credit clearance, term settlement, term settlement with credit clearance, moratorium period settlement, reversal settlement, time barred settlement and business settlements.

Legal and Regulatory Compliance:

Ensuring Compliance: They ensure that any settlement agreement complies with legal and regulatory requirements to protect the borrower.

Documentation: They handle the necessary documentation to formalize the settlement agreement.

Providing Financial Advice:

Long-Term Planning: They offer advice on managing finances post-settlement to avoid future financial distress.

Budgeting and Saving: They provide guidance on budgeting, saving, and improving credit scores.

Mediation and Conflict Resolution:

Conflict Resolution: They act as mediators in case of disputes between the borrower and lender, working to find a mutually acceptable resolution.

Objective Perspective: They provide an objective perspective, helping both parties to focus on practical solutions rather than emotional responses.

Follow-Up and Support:

Monitoring Compliance: They ensure that both parties adhere to the terms of the settlement agreement.

Ongoing Support: They provide ongoing support and advice to the borrower, helping them navigate any future financial challenges and harassment by loan recovery agents.

By leveraging their expertise and acting as a neutral intermediary, financial advisory agencies can facilitate smoother negotiations, reduce the stress on the borrower, and potentially achieve more favorable settlement terms.

The process of loan settlement proceeds smoothly if there is a financial advisory company acting as an intermediary between the loan provider and the borrower. They help prevent friction and foster a better understanding between the two parties. It is a win-win situation for all with the borrower being able to enjoy debt relief and improve his financial standing. For loan agencies, it helps them recover outstanding loans, reduces administrative costs, smoothens compliance as all regulatory requirements are complied with.

SettleMyLoan is a leading debt management and settlement company with a proven track record of helping borrowers achieve successful loan settlements. We explore all options, including debt settlement and repayment plans, to find the best solution for your unique financial situation. If you’re struggling with debt, Contact SettleMyLoan today for a free consultation and let us help you navigate a path towards financial freedom.

The bottom line rule as regards loan providers in settlement is to take it into consideration when the borrower proves financial difficulty and incapability to pay up the whole outstanding. Although this is not a requirement on cases, it is a tactful move by lenders to retrieve part of an under-performing property (NPA) without the chances of losing it altogether or suffering more legal wages plus its expenses on recovery. The agreement between the parties should be formalized in a document and it should be reported to the credit bureaus.

The most common form of loan settlement as far as loan providers are concerned is a Lump-Sum Settlement where the loan only repaid once and in however lesser sum, as a full, final payment made. Structured Settlement is another strategy where the reduced amount to be obtained is paid at set intervals in the form of regular payments. Before full settlement, some lenders may resort to any of the options of Loan Modification (altering terms such as interest or tenure), Forbearance (payment abstinence) to recover best dues they can and save on losses.

Loan settlement agency comes in as a professional medium to facilitate the deal between a distressed borrower and the loan lending company. They examine the case of the person in debt, come up with an appealing proposal after which they personally approach the lender to get them to settle the debt to a minimal amount. These agencies ensure that the lender minimizes on the losses as they clean up the debt of the borrower because they simplify communication and lay out a working recovery option.

On the part of a lender, loan settlement may be a nice idea especially when it comes to non-secured debt position that has turned into a Non-Performing Asset (NPAs). It enables them to get back at least some part of the amount outstanding, escape the long legal wrangles that are also expensive and tidy up their balance sheets. Although it amounts to a write off of the principal, it is frequently a realistic course of action in disposing of bad loans and putting resources to good use.