We all rely on our credit cards to make purchases of our daily necessities and fulfill our wants. Nowadays credit cards are becoming ubiquitous with an increasing switch by consumers to credit cards. The growth rate of credit cards in India has been surging at 20% over the last five years according to PWC.

Where there is credit card debt, there is also non payment of credit card dues. This naturally raises the question of credit card debt settlement.

You may be in possession of multiple credit cards and facing financial difficulties. Credit card settlement, also known as debt settlement, is a process where you negotiate with your credit card issuer to pay off a debt for less than the full amount owed. This typically involves negotiating a lump-sum payment that is less than the total outstanding balance due, which the creditor agrees to accept as full repayment of your credit card debt. For this purpose, a letter for credit card debt settlement is necessary.

Settle My Loan (SML) is a well-reputed financial advisory and debt settlement company with a track record of negotiating successful debt settlements in the market. You can rely on SML to negotiate a favorable credit card debt settlement on your behalf.

Assess Your Situation: Begin by reviewing your financial situation and the total amount of credit card debt you owe. Gather all your credit card statements and calculate the total debt.

Contact Your Credit Card Issuer: Reach out to your credit card company to discuss your financial difficulties. Explain your situation honestly and ask if they offer any debt relief options, such as a settlement. Write a letter for credit card settlement, explaining your financial difficulties clearly along with a concrete plan for the repayment of your credit card dues.

Make a Settlement Offer: In this letter for credit card settlement, propose a settlement amount to your credit card issuer. Typically, settlements involve paying a lump sum that is less than the full amount you owe. Start with a lower offer, as the credit card company may counter with a higher amount.

Negotiate the Terms: Engage in negotiations with your credit card issuer. Your letter for credit card settlement must be comprehensive. Be prepared to explain why you cannot pay the full amount and provide any supporting documentation if necessary. Aim to agree on an amount that you can afford to pay.

Get the Agreement in Writing: Your lender and you must reach an agreement after you have written the letter for credit card settlement. Once you and the credit card issuer agree on a settlement amount, request a written agreement that outlines the terms of the settlement. Ensure it clearly states that the settled amount will be considered as payment in full and that the remaining debt will be forgiven.

Make the Payment: Pay the agreed settlement amount by the specified deadline. Ensure you have proof of payment, such as a receipt or confirmation from the credit card company.

Confirm the Settlement: After making the payment, follow up with your credit card issuer to confirm that your account is settled. Request a letter or statement from the company that acknowledges the settlement and states that the account is closed.

Check Your Credit Report: Review your credit report to ensure that it accurately reflects the settlement. It may take a few months for the settlement to appear, but if there are any discrepancies, contact the credit bureaus to correct them.

Monitor Your Credit: Keep an eye on your credit score and credit report regularly. Settling a credit card debt can impact your credit score, but it’s important to monitor your credit to ensure there are no further issues.

Plan for the Future: Develop a budget and a plan to manage your finances better in the future. Consider seeking financial advice or credit counseling to avoid falling into debt again.

By following these steps, you can successfully navigate the credit card settlement process and work towards improving your financial health.

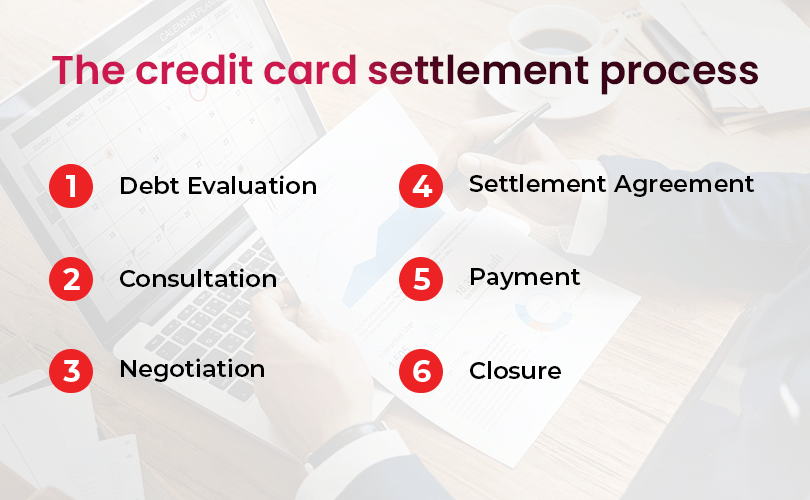

Debt Evaluation: In your letter for credit card settlement, determine the total amount of debt and what portion of the outstanding dues you have the ability to pay.

Consultation: If using a settlement company, you will have an initial consultation to discuss the debt and the potential for settlement. SettleMyLoan (SML) is an expert in this area whose services you can hire for the purpose of making a successful settlement.

Negotiation: The settlement company like SML negotiates with your credit card company to reduce the total amount of debt.

Settlement Agreement: Once an agreement is reached, you agree to the terms and conditions of the settlement in agreement.

Payment: You make the agreed-upon payment(s) to settle the debt.

Closure: The creditor reports the debt as settled to credit bureaus which is the last step.

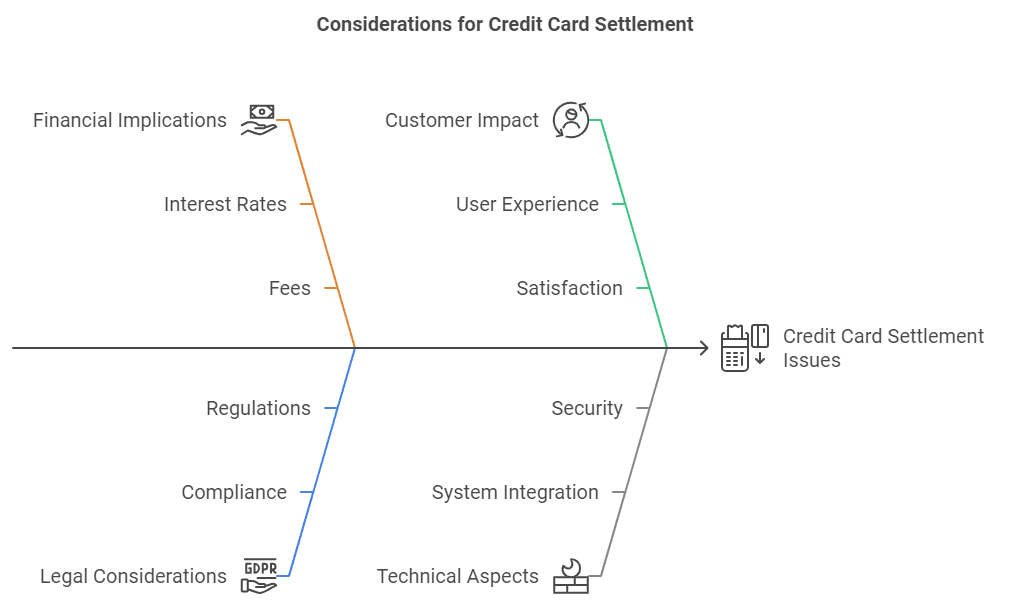

Impact on your Credit Score: Settling a debt can lower your credit score because it shows that you did not repay the debt in full.

Legal and Tax Implications: It’s important to understand that there may be tax implications for settled debts. Unpaid credit card debt which is settled is added back to your income. The forgiven amount might be considered taxable income. Additionally, there may be legal considerations if a creditor decides to sue for the full amount before a settlement is reached.

Current Financial Situation: Assess your income, expenses, and overall financial health.

Future Financial Goals: Consider how debt settlement will impact your ability to achieve long-term financial goals.

Risk Tolerance: Be honest about your ability to handle the effects of debt settlement.

Credit card debt settlement can be a viable option for some individuals, but it comes with significant risks and considerations. Here are some points to consider when evaluating whether debt settlement is a good idea for you:

Reduced Debt Amount: You may be able to settle your debt for less than what you owe, sometimes as much as 50-60% off the original balance.

Avoid Bankruptcy: Debt settlement can help you avoid filing for bankruptcy, which has a more severe and long-lasting impact on your credit score.

Single Payment Plan: Debt settlement companies often consolidate your debts into one monthly payment, which can simplify the repayment process.

Credit Score Impact: Settling debt typically involves stopping payments while negotiations are ongoing, which can damage your credit score.

Fees and Costs: Debt settlement companies charge fees for their services, which can add up and reduce the financial benefit. Settle My Loan (SML) does not impose any charges.

Tax Implications: The amount forgiven in a debt settlement can be considered taxable income under Indian tax rules.

Not Guaranteed: Creditors are not obligated to accept a settlement offer, and you could end up with a worsened financial situation if negotiations fail.

Collection Efforts: During the negotiation period, you may still face collection calls and potentially legal actions from creditors.

Debt Management Plan (DMP): Working with a credit counseling or debt management agency to develop a DMP can help you pay off your debt with reduced interest rates and fees.

Debt Consolidation Loan: This involves taking out a loan to pay off your existing debts, ideally with a lower interest rate.

Balance Transfer Credit Card: Transferring your credit card debt to a card with a lower interest rate or an introductory 0% interest can save you money on interest.

Reducing credit card debt involves a combination of strategic planning, disciplined spending, and consistent effort. Here are some effective measures:

Create a Budget:

Track your income and expenses to understand where your money is going.

Identify areas where you can cut back and allocate those savings towards your debt.

Pay More Than the Minimum:

Aim to pay more than the minimum payment each month to reduce the principal balance faster and save on interest charges.

Prioritize High-Interest Debt:

Focus on paying off credit cards with the highest interest rates first, while making minimum payments on others. This is known as the avalanche method.

Consider the Snowball Method:

Alternatively, pay off the smallest balances first to gain momentum and a sense of accomplishment, while continuing to make minimum payments on larger debts.

Consolidate Your Debt:

Look into balance transfer credit cards with low or 0% introductory interest rates or personal loans with lower interest rates to consolidate multiple debts into one payment.

Negotiate Lower Interest Rates:

Contact your credit card issuer and request a lower interest rate. A good payment history can increase your chances of success.

Limit Credit Card Use:

Avoid adding to your debt by minimizing credit card use. Stick to cash or debit cards for purchases.

Cut Unnecessary Expenses:

Identify non-essential spending that can be reduced or eliminated to free up more money for debt repayment.

Increase Your Income:

Consider taking on a part-time job, freelance work, or selling unused items to generate additional income to pay down your debt.

Set Up Automatic Payments:

Automate your payments to ensure you never miss a due date, avoiding late fees and additional interest charges.

Seek Professional Help:

If you’re struggling to manage your debt, consider consulting a financial counseling agency. They can provide personalized advice and may help you create a debt management plan.

Settling your credit card debt can provide you with significant financial relief. By negotiating with your creditors to reduce the total amount you owe, you can make a lump-sum payment that’s less than the full balance. This can help you avoid ongoing interest and fees, improve your credit score over time, and give you a fresh start. Take this step to regain control of your finances and work towards a more secure financial future.

If you are looking for a well-established debt settlement company for settling your debts, look no further than Settle My Loan (SML) which has negotiated successful credit card debt settlements on behalf of its clients at a fee on the final reduced repayment amount and not the full debt amount.

There is nothing good or bad about credit card settlement, the issue is the instrument of pregnancies statements about a financial instrument. It is good when you are under extremely bad financial conditions and really cannot possibly pay all your debt as it gives an escape route and prevents possible bankruptcy. But on the other hand, it is said to be a negative mark on your credit rating in that it may prove difficult to get new credit during a couple of years. It must be seen as a case of last resort.

When settling a debt with a credit card, you agree with the provider that you would pay a lesser amount in the form of a lump sum or installments and in exchange, they would not pursue you on the balance. After the money has been paid to the agreed amount the status of the account becomes settled on your credit report and not paid in full. This relieves you of your debt to that particular lender but sends future lenders the signal that you failed to repay the initial agreement and affects your credit status.

Paying your credit card in full when you can afford it is always a good thing to do. Full payment does not attract an interest rate profit, it positively influences the CIBIL score, and develops a superior credit rating. Settlement has the short-term benefit of eliminating unbearable debt, but the long-term disadvantage that will severely hit you credit rating.

Indeed, the settlement on credit card has a huge negative impact on your CIBIL score. Marking an account as settled but less than the full amount is a red flag to the credit bureaus and companies you wish to borrow money in the future that you have not paid them as much as you had initially agreed. This adverse comment will cost you a significant decline in your score and will usually stay in your credit file up to seven years, thus will make it more difficult to secure new credit.

Yes, absolutely. Once you have managed to settle a credit card and make the necessary payment of the settled amount, it will be of utmost importance that you get a No Objection Certificate (NOC) with your credit card issuer. This is a document that clears the debt and confirms you have no more outstanding dues in a legal manner. Never be reluctant in getting this NOC because that can be crucial evidence to you as well as to changing your status with your credit reports.

One Response

This is a very informative post 👏, specially tips for credit card selection.

I personally use Axis Bank Flipkart Credit Card and I get a lot of cashback every month on shopping. Some of its best benefits are:

5% cashback on Flipkart & Myntra shopping

4% cashback on preferred partners (Swiggy, PVR, Uber, etc.)

1.5% cashback everywhere

Fuel surcharge waiver

This is a perfect card for those who regularly shop online. Link to apply: 👉https://bitli.in/2sajMul