Loans, by themselves, are not the enemy. Used correctly, a loan is a powerful tool. It helps you buy a home, expand a business, or handle an emergency. It fuels growth.

But there is a fine line between using credit and being consumed by it. When you took the loan, you likely calculated the financial cost—perhaps 14% per annum for a personal loan or 3.5% per month for a credit card. On paper, that looked manageable.

However, for millions of Indians who slip into the “debt trap” due to lack of planning or unforeseen crises, the price tag changes drastically. You stop paying just interest; you start paying a hidden invoice every single day—not with money, but with your health, your relationships, and your dignity.

The question isn’t just “Can you afford the EMI?” The real question is: “Can you afford the stress?”

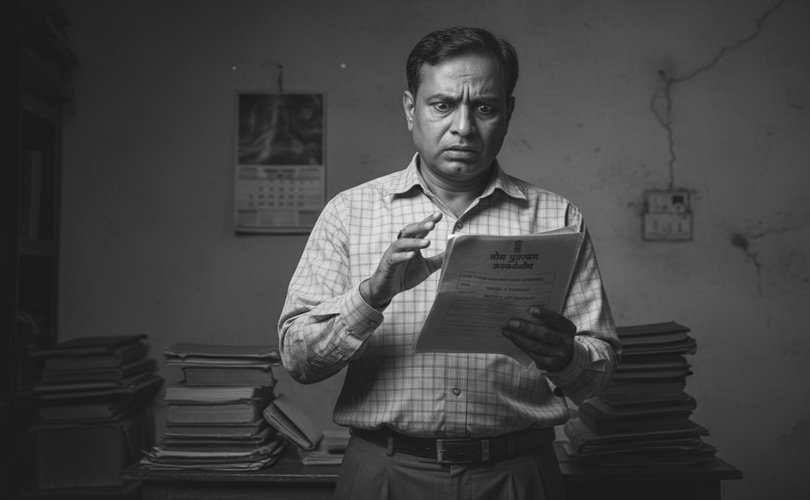

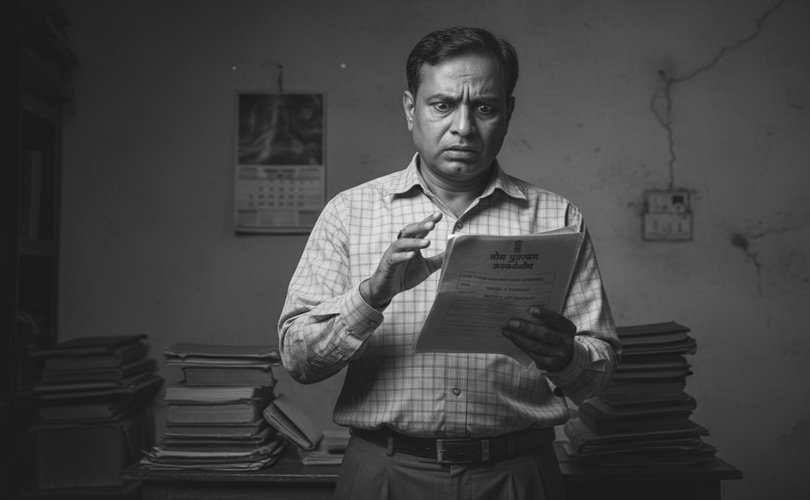

When you signed the loan agreement, nobody told you about the side effects. But as the debt piles up, the costs become visible in your mirror.

Look at the diagram above. The money you pay is just the tip of the iceberg. The massive chunk underwater? That’s your peace of mind. Are you really okay with paying this price?

Why does this stress happen? It isn’t because you are bad with money. It is often because of a misunderstanding of how credit card repayment structures work.

When you receive your credit card statement, your eyes naturally drift to two numbers: the “Total Outstanding” (which looks scary) and the “Minimum Amount Due” (which looks manageable, usually just 5% of the total). When you click “Pay Minimum,” you feel a temporary wave of relief. You think, “Okay, I’m safe for another month. I’ve maintained my record.”

But here is where the financial mechanics work against you if you rely on this long-term.

Credit cards are “unsecured” debt, meaning you didn’t pledge gold or property to get them. Because the risk to the bank is higher, the interest rates are higher—typically 36% to 42% per annum.

When you pay only the “Minimum Due,” standard accounting rules apply: your payment goes toward covering the accrued interest and taxes first. The principal amount is the last to be adjusted.

Let’s look at the math: If you owe ₹1,00,000 and your minimum due is ₹5,000, you might assume you have reduced your debt to ₹95,000. In reality: Roughly ₹3,500 to ₹4,000 of that payment is used to clear the interest and GST for that month. Only the remaining small portion—barely ₹1,000—goes toward reducing your actual loan balance.

At this rate, if you stopped spending today and only paid the minimums, it could take you years to clear that same balance.

This is why it feels like a treadmill. You are working hard and making payments faithfully, but the finish line barely moves. This isn’t a scam; it is simply how compound interest works on high-risk loans. The “Minimum Due” option is designed for temporary cash flow management, not for debt clearance. If you use it as a permanent strategy, you aren’t clearing your debt—you are just servicing it.

It is time to renegotiate the price. At Settle My Loan, we believe that no loan—and certainly no debt trap—is worth your mental health. If you have hit a financial wall—due to job loss, medical issues, or business failure—you have the right to stop the cycle.

Debt Settlement is the strategic way to lower the cost of your debt.

Imagine a life where:

Take a moment to calculate your “Total Cost of Ownership” for your debt. Add up the interest. Then add up the sleepless nights, the arguments, and the fear.

Is it too expensive?

If the answer is yes, stop paying the full price. You have options. You have rights. And you have a way out. Don’t let debt cost you your life.

Break the Debt Chain. Begin Again. Join the 45 Days Loan Settlement Challenge.

We believe in complete transparency: The calls may not stop overnight. It takes time for creditors to update their records and acknowledge our representation. However, the relief comes from knowing you are no longer facing them alone. We take over the burden of handling creditor communications on your behalf. Instead of panicking, you can confidently redirect inquiries to our team. The stress reduces significantly because you now have a professional shield and a clear strategy in place.

Financial secrecy is a relationship killer. Debt Settlement allows you to move from “hiding the problem” to “solving the problem.” By having a clear, legal plan and a timeline for being debt-free, you can finally be honest with your spouse. We have seen that when the ambiguity disappears, the tension at home drops significantly.

Yes, it is normal, but it is also unnecessary. Banks account for risk; it is part of their business model. You are not a bad person for facing a bad financial situation. Prioritizing your mental sanity and your family’s well-being over a bank’s profit margin isn’t “unethical”—it is survival.

Absolutely. Fear of public humiliation is the biggest stress trigger. As your authorized legal representatives, Settle My Loan handles all communication. If agents attempt to harass you, our legal team intervenes to ensure they follow RBI’s fair practice codes. We act as the wall between you and them.

Yes, and the data proves it. “Debt Stress” keeps your body in a permanent “Fight or Flight” mode, spiking cortisol levels. This leads to insomnia, high blood pressure, and heart risks. Treating your debt is not just a financial decision; it is a critical health intervention. You cannot earn money to pay back debt if you are sick.

Because we don’t promise magic; we promise a process. We don’t say your debt will vanish overnight. We say that with discipline, savings, and legal negotiation, it can be settled for 50% less. Thousands of our clients have walked this path and are now living debt-free. The hope is real because the legal framework (OTS) is real.