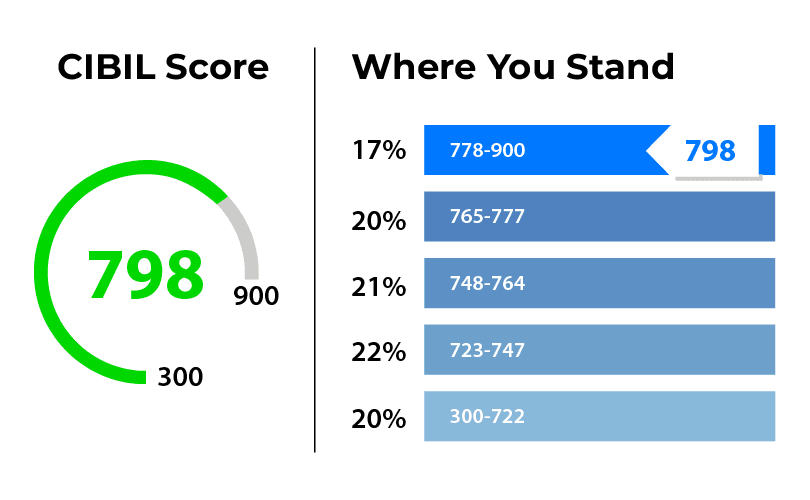

Your CIBIL score isn’t just a number—it’s a gateway to financial opportunities. A strong score (typically 750 or above) signals reliability to lenders, unlocking access to lower interest rates, higher loan amounts, and faster approvals. Imagine securing a home loan at a rate that saves you lakhs over time or effortlessly qualifying for a credit card with premium rewards. That’s the power of a good CIBIL score.

There are times when we suddenly need money, whether it’s for a medical emergency, an urgent home repair, or any other unforeseen expense. In such situations, borrowing money can often be the most practical solution. However, to ensure you can secure a loan quickly and easily, maintaining a good CIBIL score is essential.

Let’s explore what a CIBIL score is and how you can improve it if it’s not in the best shape.

The Credit Information Bureau India Limited (CIBIL) provides credit information. It has been licensed by the Reserve Bank (RBI) and tracks loan-related activities of individuals and companies. Its rating is called CIBIL score.

A CIBIL score or rating is a measure of your ability to take out a loan and repay it. There is a range of 300 to 900. 300 to 600 indicates that you are very bad at repaying loans. On the other hand, a CIBIL score of 750 to 900 indicates excellent loan repayment history.

If you have a credit score of less than 750, you may have difficulty obtaining a loan. There is a possibility that you won’t even get a credit card. But there is a good thing: the CIBIL score can also be improved. Here are five ways to improve your CIBIL score.

1. Repay the loan on time

A late payment has a very bad effect on your CIBIL score. You should always pay your EMIs on time, because missed payments not only cost you money, but also hurt your credit score.

2. Build a good credit balance

You should have a good mix of secured loans, such as home loans and car loans, as well as unsecured loans like personal loans and credit cards. NBFCs and banks usually prefer secured loans.

If you have more unsecured loans, you should pay them off first to maintain a good credit score. If you are using a credit card, try to pay it off before the due date. It’s a good way to improve your credit score.

3. Do not keep balance in credit card

Make sure you pay off your credit card before the due date if you have used one. You can improve your credit score by doing this.

4. Avoid becoming a loan guarantor

You should avoid opening a joint account with someone or becoming a guarantor. It can also affect your CIBIL score if the other party defaults. Additionally, you should avoid taking out multiple loans at once. If you wish to take out a second loan, complete the first one first. This will also help improve your credit score.

5. Use credit card within limits

Avoid using the full credit card limit on your card; this can help improve your credit score quickly. Spend no more than 30 percent of your credit limit each month. Overspending shows that you are unable to control your spending and are heavily dependent on debt.

Also, when you take out a loan, you should choose a longer repayment period. This will reduce your EMI and give you more time to repay the loan. Due to this, your CIBIL score will automatically improve, as will your chances of defaulting.

It largely depends on your financial situation. Your credit score can improve within 4 to 13 months if you repay your debts on time and use your credit cards responsibly. However, the fundamental principle remains that you need to be disciplined in managing your spending.

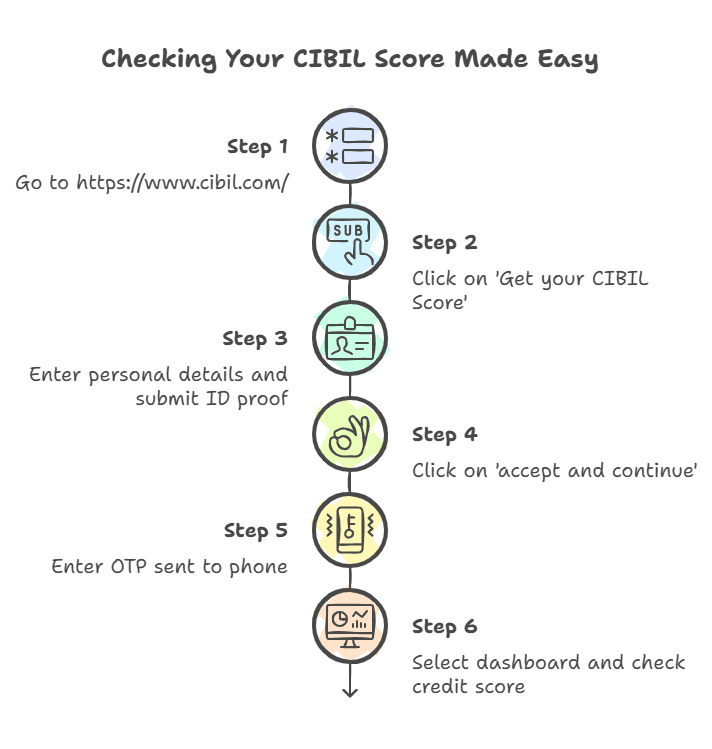

Step 1: Go to https://www.cibil.com/.

Step 2: Click on ‘Get your CIBIL Score’.

Step 3: Enter your name, email address, and password. Submit an ID proof. Next, enter your PIN code, date of birth, and phone number.

Step 4: Click on ‘accept and continue’.

Step 5: An OTP will be sent to your registered phone number. Select ‘Continue’ after typing that.

Step 6: Then select your dashboard and check your credit score.

If you’re struggling with debt or finding it challenging to improve your CIBIL score on your own, Settle My Loan is here to help. Our experienced team of financial experts provides personalized debt management solutions tailored to your unique situation. We can assist you in negotiating with creditors, creating a manageable repayment plan, and guiding you towards a brighter financial future.

Improving your CIBIL score is a journey that requires patience and consistent effort. By adopting responsible financial habits such as timely payments, maintaining a healthy credit mix, and regularly monitoring your credit report, you can significantly enhance your creditworthiness over time. Remember, a good CIBIL score not only opens doors to better financial products but also provides a sense of financial well-being and stability. Contact Settle My Loan today for a free consultation and take the first step towards reclaiming your financial freedom.

Also Read:

https://settlemyloan.in/blog/loan-scams-how-to-find-out-how-many-loans-and-credit-cards-are-active-in-your-name/

To convert a poor CIBIL score into a good one requires perseverance and financial responsibility. Pay attention to making timely payments on all your EMI and credit cards, and the payment history is the most important criterion. Keep the outstanding debts low in relation to your limits in credit. It is also not advisable to take up excess new credit within a certain time span and it is also advisable to check your CIBIL report regularly to address any errors in this.

It is impossible to just remove a low CIBIL score because it is a picture of credit performance. Nevertheless, you can greatly fix it by going to its causes. Challenge errors on your statement with CIBIL. What is more crucial, you should maintain the track record of regular and prompt payments, use your credit wisely and put in consideration, addressing your old debts which remain unpaid through a legitimate source. In the long run, the good deeds will increase dramatically compared to the bad records.

The current CIBIL score between 650 and 950 may be deemed as average, or fair, in India, short of the good or excellent score, which is what most lenders observe (usually 700+). Although a score of 650 might still allow you to take up some loans or credit cards, it may have an increased interest rate or the terms being stagnant. It denotes being in a fair amount of financial risk to your lenders and points at areas of bettering your credit style.

CIBIL does not reset in 7 years. Rather, the negative information about defaults, written off accounts, or settled debts tend to stay in your CIBIL report as long as around 7 years after the last activity or default. Although these older entries will grow less influential with the passing years and will finally fade in the end, your total credit history is long-term and new, good habits are a requirement to conduct active credit rebuilding.

In India the CIBIL scores of 700 and higher are usually considered good and 750-900 is an excellent CIBIL score. This scale is a measure of excellent credit score and accountable payment record and hence decisions concerning loans are more likely to be approved within good terms and interest rates. A good CIBIL score makes a person reliable to lenders, and this can help you improve your financial possibilities.