Over the past few years, cybercrime has become a fast-emerging problem in the country. Nowadays, many people take loans or issue credit cards to someone without their knowledge. And to avoid such frauds, you must safeguard yourselves.

The fraud cases have increased in the digital era. In this regard, the government takes many steps to prevent such frauds. By the time the person comes to know about this loan, it’s too late.

Today, we are going to see how you can get such information of whether a loan has been taken or a credit card issued in your name or not.

Did you know that in 2021 alone, over 45,000 cases of loan fraud were reported in India, amounting to nearly ₹4.92 trillion? As cybercrime continues to rise, protecting your financial identity has never been more crucial.

You can easily know how many loans or credit cards are issued in your name by checking your credit report. Your CIBIL score will show how many loans or credit cards you have associated with your name, so it’s very easy to check.

For free, you can check your CIBIL score on several apps like CIBIL.com, Paytm, Google Pay, etc.

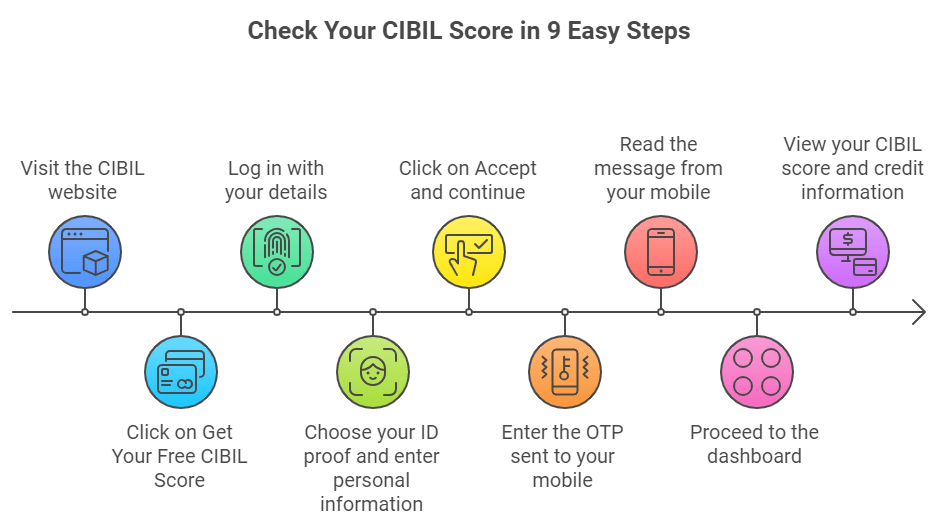

Step 1: Check out your CIBIL score here www.cibil.com

Step 2: From the home page, click on “Get Your Free CIBIL Score.

Step 3: Log in by filling in name, email ID, and password.

Step 4: After the login process, you have to choose your ID proof, enter your PIN code, date of birth, and mobile number.

Step 5: Once you have filled all this, click on “Accept and continue.”

Step 6: Now, OTP will be sent in your registered mobile number. So, enter that one.

Step 7: After entering that OTP, you will get a massage from your mobile.

Step 8: Then proceed further to the dashboard.

Step 9: Here, your CIBIL score will appear and you can also see how many loans or credit cards are issued in your name.

Also Read: [https://settlemyloan.in/everything-know-loan-settlement-loan-provider/]

Having wrong loans or credit cards on your CIBIL report can cause problems like:

Over the past few years, cybercrime has become a fast-emerging problem in the country. Nowadays, many people take loans or issue credit cards to someone without their knowledge. And to avoid such frauds, you must safeguard yourselves.

The fraud cases have increased in the digital era. In this regard, the government takes many steps to prevent such frauds. By the time the person comes to know about this loan, it’s too late.

Today, we are going to see how you can get such information of whether a loan has been taken or a credit card issued in your name or not.

Did you know that in 2021 alone, over 45,000 cases of loan fraud were reported in India, amounting to nearly ₹4.92 trillion? As cybercrime continues to rise, protecting your financial identity has never been more crucial.

If you detect an irregularity in your CIBIL score, then immediately contact the credit bureau and lender asking them to rectify it as quickly as possible.

In today’s digital world, safeguarding your financial identity is essential. With loan scams on the rise, being proactive about monitoring your credit report can help you detect unauthorized activities early. By regularly checking your CIBIL score and understanding how to manage your financial information, you can protect yourself from falling victim to fraud. Remember, knowledge is power—stay informed and take action to secure your financial future.

To detect the existence of any other fake or unauthorized loans against your name, review your credit with all the major credit bureaus on the regular basis such as CIBIL, Experian and Equifax. Each of them provide one free credit report per year. Search your accounts to see any names you do not recognize, loans that you do not know were requested as well as addresses that are not familiar. A discrepancy is a red flashing mode of possible fraud that is to be acted upon.

In case you find a fake loan in your CIBIL report you should at first file a dispute with CIBIL on their online site. Present all the additional information and documents that will confirm that the loan does not belong to you (e.g., police report, bank document which would confirm that you did not get money). CIBIL then will find out with the lender and in case it is confirmed as a fraud the entry will be deleted in your report.

When a loan is opened on your name by another person, chances are that you are a victim of identity theft. Initial step is to report a crime by going to the police. Next, show the lender and explain that the loan was a fraud and ask him to close the account that was fraudulently opened. Most importantly, put a fraud alert or a credit freeze with all credit departments (CIBIL, Experian, Equifax) in order to deter subsequent abuse of your identity.

In most cases, you must repay the balance of the loans you have taken to repay the outstanding balance of loans, together with interest. When you have paid the full amount, make sure you get a No Objection Certificate (NOC) that the lending company will issue to you stating that you have no outstanding balances, and the loan has been settled.

In the case of repayment of loans you find it hard to pay, then you can turn to a company like Settle My Loan to work out settlement possibilities as a means of formally settling the account.

How to report a fake loan on CIBIL? First of all, you will have to obtain the entire credit report and figure out the false loan entry. Usefully, then, go to the official CIBIL website, and go to their dispute resolution area. To carry an online dispute, you will be required to log in/register with the website, followed by entering the information of the unauthorized loan and uploading supported documentations, e.g., police complaint.

Red flags include lenders who are not registered with the RBI, have no physical office, offer guaranteed approval without checking your credit, demand upfront fees, or provide limited-period schemes with very low-interest rates. If the offer seems too good to be true, it likely is.