Did you know even small errors in your CIBIL report can impact your loan eligibility?

If you find an error in your CIBIL credit report, you can fix it by following the CIBIL Dispute Resolution process. Start by logging into your CIBIL account and identifying the incorrect information. Next, submit an online dispute by filling out the dispute resolution form, clearly explaining the error. CIBIL will investigate and verify the disputed item with the relevant financial institution. This process may take up to 30 days, after which CIBIL will update your report if the error is confirmed. You can track the status of your dispute through your CIBIL account.

Settle My Loan is a financial advisory and debt settlement company that facilitates debt settlement and encourages adoption of best practices for debt management measures by its clients.

The CIBIL (Credit Information Bureau (India) Limited) Dispute Resolution process is initiated for several reasons related to inaccuracies or discrepancies in an individual’s credit report. Common reasons include:

Incorrect Personal Information: Errors in personal details such as name, date of birth, address, or identification numbers.

Inaccurate Account Information: Mistakes in the details of credit accounts, such as incorrect loan amounts, payment dates, or account status.

Duplicate Accounts: Instances where the same account is listed multiple times on the credit report.

Closed Accounts Reported as Open: Accounts that have been closed but are still reported as open.

Unknown Accounts: Accounts listed in the report that the individual does not recognize or did not open, which could indicate identity theft or fraud.

Incorrect Payment Status: Errors related to the payment history, such as timely payments being marked as late or missed payments.

Data Entry Errors by Lenders: Mistakes made by banks or financial institutions in reporting data to CIBIL.

Initiating a CIBIL dispute resolution process allows individuals to correct these inaccuracies, ensuring their credit report reflects their true credit history. This is crucial as the credit report directly impacts an individual’s credit score and their ability to obtain loans, credit cards, and other financial products.

A healthy credit score is crucial for financial well-being. If you spot errors in your CIBIL report, you can challenge them. Here’s what you can dispute:

Personal Information

Name: Incorrect or misspelled names.

Date of Birth: Wrong birthdate.

Gender: Incorrect gender.

Identification Numbers: Errors in PAN, Aadhaar, passport, or voter ID.

Contact Details: Incorrect address, phone number, or email.

Account Information

Account Details: Wrong account numbers, loan amounts, or credit limits.

Account Type: Misclassified account (e.g., personal loan listed as a home loan).

Current Balance: Incorrect outstanding amount.

Payment History: Late payments marked incorrectly (e.g., payments made on time shown as late).

Account Status: Closed accounts shown as open, or vice versa.

Ownership: Accounts listed that don’t belong to you.

Employment Information

Employer Details: Incorrect employer name or employment dates.

Occupation: Wrong job title or occupation.

Credit Inquiries (or Credit Checks)

Unauthorized Inquiries: Credit checks made without your permission.

Incorrect Inquiry Dates: Wrong dates for credit checks.

Account Conduct

Defaults: Incorrectly reported missed payments.

Settlements: Issues with how settlements are reported.

Write-offs: Incorrect or outdated information about written-off debts.

Ownership Details

Joint Accounts: Errors in ownership information for shared accounts.

Guarantor Information: Incorrect details if you’re a guarantor for someone’s loan.

Public Records

Legal Actions: Incorrect information about lawsuits or court judgments.

Bankruptcy: Errors in bankruptcy information.

Collections

Collection Accounts: Inaccurate details about debts sent to collection agencies.

Settlement Amounts: Incorrect amounts reported for settled debts.

Remember: Providing clear and accurate information is key to a successful dispute. Gather supporting documents like payment receipts or bank statements.

If you find any errors, start the dispute process right away. A good credit score opens doors to better financial opportunities.

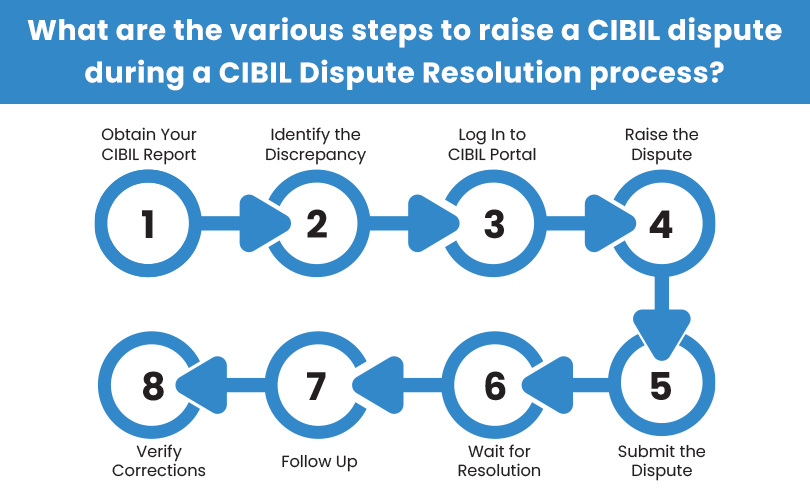

Raising a CIBIL dispute involves several steps to ensure that any errors in your credit report are corrected. Here’s a step-by-step guide:

Purchase the Report: Obtain a copy of your CIBIL credit report. This can be done through the CIBIL website or other authorized channels.

Review the Report: Carefully go through the report to identify any inaccuracies or discrepancies.

Note the Details: Record the details of the error, including the section of the report where it appears and the specific data that is incorrect.

Access the Portal: Go to the CIBIL website and log in using your credentials. If you don’t have an account, you’ll need to create one.

Navigate to Dispute Section: Once logged in, find the section for raising disputes. This is usually under “Credit Reports” or “Disputes.”

Fill Out the Form: Complete the online dispute form. You’ll need to provide details such as your name, address, and the specific error you wish to dispute.

Select Dispute Type: Choose the type of dispute, whether it’s a data inaccuracy or an account-related issue.

Provide Supporting Documents: Attach any necessary documents that support your claim. This might include bank statements, loan agreements, or correspondence with creditors.

Review and Submit: Double-check all the information you have entered, and then submit the dispute.

CIBIL Investigation: CIBIL will forward your dispute to the relevant financial institution for verification and for the completion of the CIBIL Dispute Resolution process.

Response Time: The financial institution has 30 days to respond. During this time, CIBIL will keep you updated on the status of your dispute.

Check Updates: Regularly log in to the CIBIL portal to check the status of your dispute.

Receive Resolution: Once the dispute is resolved during the CIBIL Dispute Resolution process, CIBIL will update your credit report if necessary, and you’ll be notified of the changes.

Obtain Updated Report: After the dispute is resolved, get a new copy of your credit report to verify that the corrections have been made.

Check for Accuracy: Ensure that the errors have been corrected and there are no new discrepancies.

Additional Tips

Keep Records: Maintain records of all communications and documents related to your dispute.

Follow Up: If you don’t hear back within the stipulated time, follow up with CIBIL for an update.

By following these steps, you can ensure that any inaccuracies in your CIBIL report are addressed and corrected promptly.

Don’t let CIBIL errors hold you back. Resolving a CIBIL dispute is the first step to unlocking a world of financial opportunities. By taking the time to correct inaccuracies in your credit report, you can significantly improve your credit score, qualify for better loan terms, and even increase your chances of securing your dream home or car.

SettleMyLoan is here to guide you through the entire process. Our expert team provides comprehensive financial advisory and debt settlement solutions including credit clearance settlement to help you achieve financial freedom.

Start your journey to a better financial future today. Contact SettleMyLoan for a free consultation.

We can negotiate your settlement so that you become debt free, in most cases without it affecting your credit score.