Case Study 1: One time Settlement (OTS)

One Time Settlement (OTS) for a businessman wishing to clear two loans. Total outstanding debt was ₹19,13,269 settlement agreed for ₹6,40,000 enabling the client to be debt free with a saving of ₹12,73,269

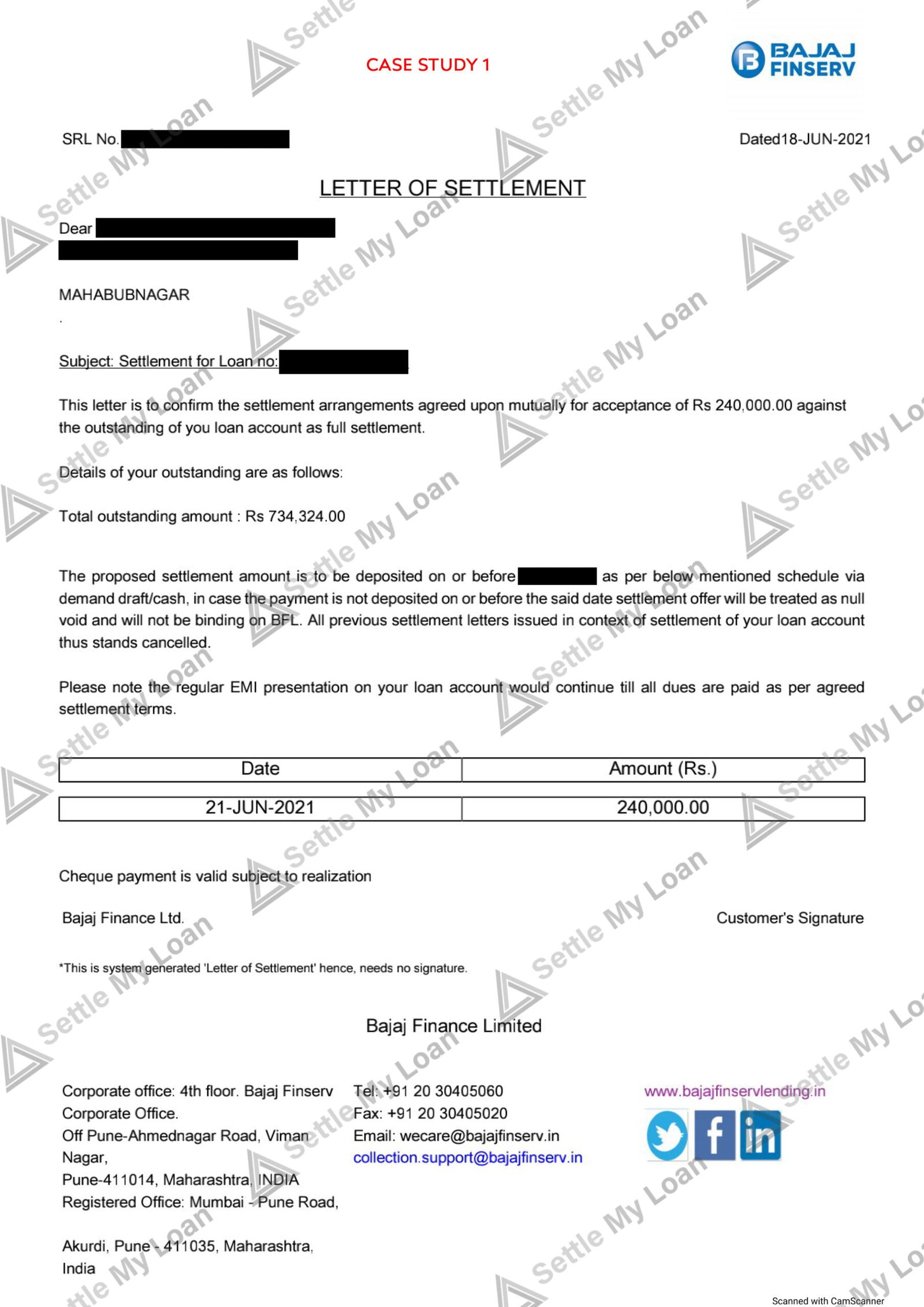

A company director from Mahabubnagar had approached us to obtain a settlement for two of his loans. He was struggling to service them due to a downturn in business because of the Covid-19 lockdown and wanted to be debt free. He was experiencing creditor harassment with continuous calls and visits to his business address.

He had unsecured loans from Bajaj Finserv and had missed 6 EMI payments. The total outstanding debt was ₹19,13,269. We were able to negotiate a one-time settlement with a 67% discount reducing the balance owed to just ₹6,40,000 as full settlement of the loans. Saving him ₹12,73,269 from the original balance due.

Our Advocates checked the authenticity of the bank’s settlement, vetted the settlement letters to ensure that the debt was marked as full and final as per the negotiated terms.

8 Responses

Hey,

The moment we’ve all been waiting for is finally here – GoBuildr is now LIVE! 🎉

🌐 Create ultra-lightning-fast websites, sales funnels, eCommerce stores, and more in less than 60 seconds, with just a keyword!

🚀 Say goodbye to the limitations of traditional page builders. GoBuildr combines the functionality of 16 different tools into one powerful app, supercharged with AI-assisted technology.

⇒ Click Here To Checkout Demo https://ext-opp.com/GoBuildr

Hey,

The moment we’ve all been waiting for is finally here – GoBuildr is now LIVE! 🎉

🌐 Create ultra-lightning-fast websites, sales funnels, eCommerce stores, and more in less than 60 seconds, with just a keyword!

🚀 Say goodbye to the limitations of traditional page builders. GoBuildr combines the functionality of 16 different tools into one powerful app, supercharged with AI-assisted technology.

⇒ Click Here To Checkout Demo https://ext-opp.com/GoBuildr

Hey,

The moment we’ve all been waiting for is finally here – GoBuildr is now LIVE! 🎉

🌐 Create ultra-lightning-fast websites, sales funnels, eCommerce stores, and more in less than 60 seconds, with just a keyword!

🚀 Say goodbye to the limitations of traditional page builders. GoBuildr combines the functionality of 16 different tools into one powerful app, supercharged with AI-assisted technology.

⇒ Click Here To Checkout Demo https://ext-opp.com/GoBuildr

Hey,

The moment we’ve all been waiting for is finally here – GoBuildr is now LIVE! 🎉

🌐 Create ultra-lightning-fast websites, sales funnels, eCommerce stores, and more in less than 60 seconds, with just a keyword!

🚀 Say goodbye to the limitations of traditional page builders. GoBuildr combines the functionality of 16 different tools into one powerful app, supercharged with AI-assisted technology.

⇒ Click Here To Checkout Demo https://ext-opp.com/GoBuildr

Hey,

The moment we’ve all been waiting for is finally here – GoBuildr is now LIVE! 🎉

🌐 Create ultra-lightning-fast websites, sales funnels, eCommerce stores, and more in less than 60 seconds, with just a keyword!

🚀 Say goodbye to the limitations of traditional page builders. GoBuildr combines the functionality of 16 different tools into one powerful app, supercharged with AI-assisted technology.

⇒ Click Here To Checkout Demo https://ext-opp.com/GoBuildr

Hey,

The moment we’ve all been waiting for is finally here – GoBuildr is now LIVE! 🎉

🌐 Create ultra-lightning-fast websites, sales funnels, eCommerce stores, and more in less than 60 seconds, with just a keyword!

🚀 Say goodbye to the limitations of traditional page builders. GoBuildr combines the functionality of 16 different tools into one powerful app, supercharged with AI-assisted technology.

⇒ Click Here To Checkout Demo https://ext-opp.com/GoBuildr

Hey,

The moment we’ve all been waiting for is finally here – GoBuildr is now LIVE! 🎉

🌐 Create ultra-lightning-fast websites, sales funnels, eCommerce stores, and more in less than 60 seconds, with just a keyword!

🚀 Say goodbye to the limitations of traditional page builders. GoBuildr combines the functionality of 16 different tools into one powerful app, supercharged with AI-assisted technology.

⇒ Click Here To Checkout Demo https://ext-opp.com/GoBuildr

Bajaj finserve gave me a loan of 1600000 plus in the year 2023, the insurance amount of 131000 was deducted at source from loan capital, my monthly emi is 80281 per month for 2 years , now facing problem paying emi , these people are so heartless, they visit my residence every day without information and when I said i hv insurance, they say it’s for Bajaj , and insurance has no benifit to customer(me) this is heights, last month I had to borrow money to pay emi because they kept on visiting and calls were really bothering .